转发:Answer

谢谢亲的回惠顾,期待您的下次光临! 添加客服微信:bbwxnly,购买沟通交流so easy 欢迎咨询以下我们的一站式服务内容:课后习题解答查题|文件文档解锁下载|会员帐号包月月卡 Bartleby|Bookrags|brainly.com|Coursehero|Chegg|eNotes|Ebook|gradebuddy|Grammerlly|Numerade |QuillBot|Oneclass|Studypool|SaveMyEaxms|Studymode|ScholarOne|SlideShare|SkillShare|Scribd|SolutionInn|Study.com|Studyblue|Termpaperwarehouse|and more… 谢谢亲的支持,祝您学习愉快:) |

Question:The following balance sheets have been prepared as at December 31, Year 6, for Kay Corp. and Adams Ventures:

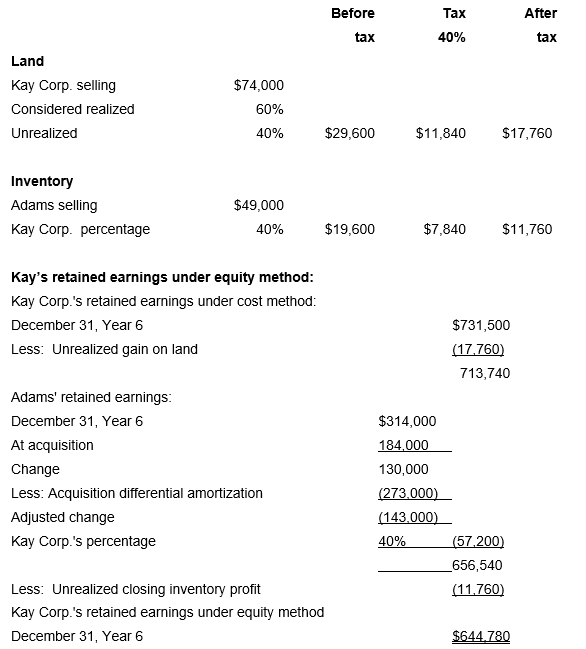

Additional Information: • Kay acquired its 40% interest in Adams for $374,000 in Year 2, when Adams's retained earnings amounted to $184,000. The acquisition differential on that date was fully amortized by the end of Year6. • In Year 5, Kay sold land to Adams and recorded a gain of $74,000 on the transaction. Adams is still using this land. • The December 31, Year 6, inventory of Kay contained a profit recorded by Adams amounting to $49,000. • On December 31, Year 6, Adams owes Kay $43,000. • Kay has used the cost method to account for its investment in Adams. • Use income tax allocation at a rate of 40%, but ignore income tax on the acquisition differential. Required: (a) Prepare three separate balance sheets for Kay as at December 31, Year 6, assuming that the investment in Adams is a (ii) joint operation and is reported using proportionately adjusted financial statements, and (iii) significant influence investment. (b) Calculate the debt-to-equity ratio for each of the balance sheets in part (a). Which reporting method presents the strongest position from a solvency point of view? Briefly explain. (c) Prepare the financial statements required for part (a) using the worksheet approach. Answer:(a)

(i) Control investment – full consolidation Intercompany profit:

Consolidated retained earnings

Non-controlling interest: (Method 2) NCI, date of acquisition $561,000 Change in Adam's retained earnings since acquisition (172,400) NCI's share x 60% (103,440) $457,560

(ii) Joint operation investment – proportionately adjusted financial statements Intercompany receivable/payable (43,000 x 40%) 17,200 Intercompany profit

Kay Corp. Consolidated Balance Sheet at December 31, Year 6

(b) i ii iii Debt $1,666,500 $1,225,500 $931,500 Equity 2,031,700 1,600,780 1,600,780 Debt to equity ratio 0.82 : 1 0.77 : 1 0.58:1 The third scenario for the significant influence investment shows the best solvency position i.e. the lowest debt to equity ratio since it does not include any of the debt of the associate. (c) See below for summary of journal entries.

JOURNAL ENTRIES Part a) i) 1 Retained earnings (note a) 113,360 Investment in Adams 113,360 To adjust retained earnings to equity method at end of year

2 Investment in Adams 457,560 Non-controlling interest 457,560 To establish non-controlling interest at end of year

3 Common shares 478,000 Retained earnings 314,000 Investment in Adams 792,000 To eliminate subsidiary's shareholders' equity and establish acquisition differential at end of Year 6

4 Investment in Adams 29,400 Inventory 49,000 Deferred income taxes 19,600 To eliminate unrealized profits in ending inventory

5 Investment in Adams 44,400 Property and plant 74,000 Deferred income taxes 29,600 To eliminate unrealized profits in land

6 Accounts payable 43,000 Accounts receivable 43,000 To eliminate intercompany receivables and payables JOURNAL ENTRIES Part a) ii) 1 Retained earnings (note b) 86,720 Investment in Adams 86,720 To adjust retained earnings to equity method at end of year

2 Common shares 191,200 Retained earnings 125,600 Investment in Adams 316,800 To eliminate subsidiary's shareholders' equity and establish acquisition differential at end of Year 6

3 Investment in Adams 11,760 Inventory 19,600 Deferred income taxes 7,840 To eliminate unrealized profits in ending inventory

4 Investment in Adams 17,760 Property and plant (net) 29,600 Deferred income taxes 11,840 To eliminate unrealized profits in land

5 Accounts payable 17,200 Accounts receivable 17,200 To eliminate intercompany receivables and payables JOURNAL ENTRIES Part a) (iii) 1 Retained earnings 86,720 Investment in Adams (note b) 86,720 To adjust retained earnings to equity method at end of year

Notes a Consolidated retained earnings, Dec. 31, Year 6 $ 618,140 (= Kay's retained earnings, end of Year 6 under equity method) Kay's retained earnings, end of Year 6 under cost method 731,500 Difference between cost and equity method, end of year $(113,360)

b Kay's retained earnings, end of Year 6 under equity method $644,780 Kay's retained earnings, end of Year 6 under cost method 731,500 Difference between cost and equity method, end of year $ (86,720) 谢谢亲的回惠顾,期待您的下次光临! 添加客服微信:bbwxnly,购买沟通交流so easy 欢迎咨询以下我们的一站式服务内容:课后习题解答查题|文件文档解锁下载|会员帐号包月月卡 Bartleby|Bookrags|brainly.com|Coursehero|Chegg|eNotes|Ebook|gradebuddy|Grammerlly|Numerade |QuillBot|Oneclass|Studypool|SaveMyEaxms|Studymode|ScholarOne|SlideShare|SkillShare|Scribd|SolutionInn|Study.com|Studyblue|Termpaperwarehouse|and more… 谢谢亲的支持,祝您学习愉快:) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

评论

发表评论